Can I Get A Mortgage On Universal Credit?

Absolutely! Despite being on Universal Credit, you can secure a mortgage. Lenders evaluate affordability, and while some may hesitate, others approve. Choose wisely to achieve homeownership.

Today, many individuals still aim to own a home, even if they receive benefits. At Expert Mortgage Brokers, we recognize the importance of addressing the unique challenges faced by this demographic.

In this comprehensive guide, we shed light on the possibility of obtaining a mortgage while on benefits. We debunk myths and provide valuable insights.

Can I get a mortgage while on universal credit?

Yes, it is possible to qualify for a mortgage if you receive government benefits. Lenders consider factors like:

- Affordability – Can you afford the monthly mortgage payments and interest?

- Income Sources – Many require additional income beyond just benefits.

- Down Payment – More benefit reliance may mean a larger down payment is needed.

- Benefit Duration – May limit mortgage term if benefits have an end date.

How do you get a mortgage while on benefits?

Getting a mortgage while on benefits takes extra steps but is possible. Lenders will closely check your application and credit score to see if you can make payments. Good credit helps approval chances. Here are tips to boost your credit score:

- Register to vote to get on the electoral roll

- Get copies of your credit file and fix any errors

- Watch for false entries and identity theft

- Pay all bills on time to manage credit

- Pay down existing debts

- Check for financial ties to others

- Avoid moving too much

- Get debt advice if needed

A mortgage broker can explain programs and incentives that help those on benefits buy a home. For example, semi shared ownership lets you buy part of a home and rent the rest. Housing benefit helps cover rent or mortgage costs. Meeting with a broker starts the mortgage application process to make your home ownership dream a reality.

What benefits can count as income when applying?

Most benefits can count as income when applying for a mortgage. But each lender has different rules on which ones they accept. Even lenders open to benefits may not take certain types.

Some more widely accepted options are:

- Universal Credit

- Pension Credit

- Bereavement Support Payment

- Child Tax Credit

- Child Benefit

- Carer’s Allowance

- Attendance Allowance

- Disability Living Allowance

- Personal Independence Payment

- Maternity Allowance

- Employment and Support Allowance (ESA)

Meeting with a mortgage broker is the best way to find lenders willing to use your benefits for approval. They have access to many lenders and programs. This saves you time searching for yourself. The broker can explain the lender’s criteria, interest rates, fees, and affordable housing incentives. Checking your credit score beforehand also helps assess your chances. Starting the mortgage application process gets you closer to your dream home.

RECOMMENDED READS:

Drawbacks of being on benefits when securing a mortgage

Being on benefits doesn’t automatically prevent you from qualifying for a mortgage. But lenders must check you can make the payments.

Those relying on benefits often have limited income. This can affect the loan amount you are approved for. Past credit issues can also cause problems. Falling behind on bills hurts your credit score.

Working with a mortgage broker opens doors. They know lenders and programs for benefit recipients. Brokers explain eligibility criteria, interest rates, fees, and incentives.

Options like semi-shared ownership let you buy part of a home and rent the rest. Housing benefit assists with costs. Checking your credit score shows where you stand. Paying bills on time and lowering debts can improve it.

Don’t lose hope. With the right broker and plan, the dream of home ownership on benefits can become a reality. Starting the application process gets you one step closer.

How lenders calculate the mortgage amount you can get on benefits

Lenders look at your total annual income and multiply it. For example, if your benefit income is £2,000 yearly and your job income is £14,000, the total is £16,000. Multiplied by 4.49, this means you may qualify for a £71,840 mortgage.

Getting a joint mortgage while on benefits

For a joint mortgage, both incomes are combined. If your income is £16,000 and your partner’s is £18,000, the total is £34,000. Multiplied by 4.49, you may qualify for a £152,660 mortgage together.

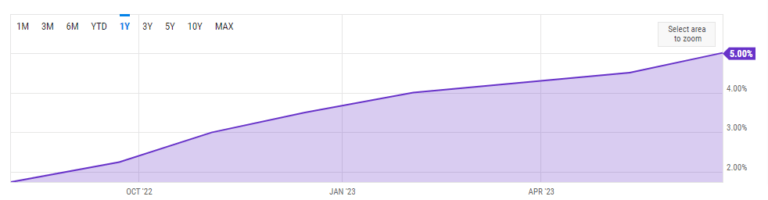

Lenders also consider your debts, bills, credit scores, and financial history. Lower credit scores can mean higher mortgage interest rates. A mortgage broker can find lenders who use universal credit and other benefits for approval. They know programs that reduce down payments and interest.

Mortgage options available when on benefits

Many types of mortgages exist – repayment, interest-only, fixed-rate, adjustable rate, and more. Comparing options is key to finding what fits your situation best.

There’s no single “best” mortgage for everyone. But those on benefits can qualify for most types if they show they can make payments long-term.

Getting a buy-to-let mortgage on benefits

You can also apply for buy-to-let mortgages while receiving benefits. Some lenders will consider your benefit income for approval. But you may face stricter affordability rules and have fewer lender choices.

Working with a broker opens doors. They know lenders who accept universal credit and other benefits. Brokers access programs that reduce down payments and interest rates.

Check your credit score and start the application process. With dedication and the right lender, getting a mortgage while relying on benefits is achievable. Soon you’ll be making mortgage payments on the home of your dreams.

RECOMMENDED READS:

Achieving homeownership goals while on benefits

Purchasing a home when relying on government benefits may seem daunting. But with the right mortgage broker, your dreams can become a reality. Our experienced advisors open doors with lenders that understand your unique needs.

We know the programs that can help you

- Shared equity models to reduce down payments

- Mortgage interest support for eligible borrowers

- Lenders willing to approve those on universal credit

- Benefit recipient grants and incentives

It starts with a conversation

Schedule a free consultation and we’ll guide you through the mortgage process from start to finish. We’ll assess your options, explain requirements, and assist with documentation. We aim to secure favorable terms so you can start making payments on your new home.

Take control of your financial future

Homeownership allows you to build equity and invest in your future security. By working together, we can help you qualify for a mortgage and programs to reduce interest. Contact us today to start your journey!

At Expert Mortgage Brokers, our mortgage brokers succeed where others fall short. We have the expertise and determination to make your home-buying dreams a reality, even while relying on benefits. Let’s get started!