Tracker Mortgage

A tracker mortgage is a variable-rate loan, where the interest rates tracks the Bank of England base rate. This is done on a pre-set rate by the lenders.

The following topics are covered below:

What is Tracker Mortgage?

A tracker mortgage is a house loan in which the interest rate moves in lockstep with another rate, most commonly the Bank of England base rate. As a result, if you think the base rate of interest may reduce or if tracker mortgage rates are currently low relative to other forms of mortgages, you might want to choose a tracker mortgage. However, interest rates on a tracker mortgage, like all variable rate mortgages, can rise as well as reduce. As a result, consider if your finances can manage an increase in your monthly mortgage payments if this occurs.

How does tracker mortgages work?

Importantly, the interest you pay on a tracker mortgage is frequently different from the tracked rate. This is because tracker rates are often priced a specific percentage point above, or sometimes below, the rate to which they are tied. For example, if your tracker mortgage is set at a base rate plus 1.5 percent and a base rate of 0.5 percent, your monthly repayments will be based on a 2 percent interest rate. Your mortgage interest rate would increase to 2.5 percent if the Bank of England raised the base rate to 1%. Let us say you have a £200,000 mortgage with a 25-year term and a rate of 1.5 percent higher than the base rate. If the base rate is 0.5 percent, your tracker mortgage will have a rate of 2 percent, resulting in a monthly repayment of £848. If the base rate rises by 0.5 percent to 1%, your tracker rate rises to 2.5 percent, and your monthly payments jump by £49 to £897. This would cost you an additional £588 each year.

What is needed for a tracker mortgage?

A tracker mortgage is the same as fixed rate mortgages in terms of what is needed.

However, it is imperative to keep in mind that there may be mortgage fluctuations if the BoE interest rates rise.

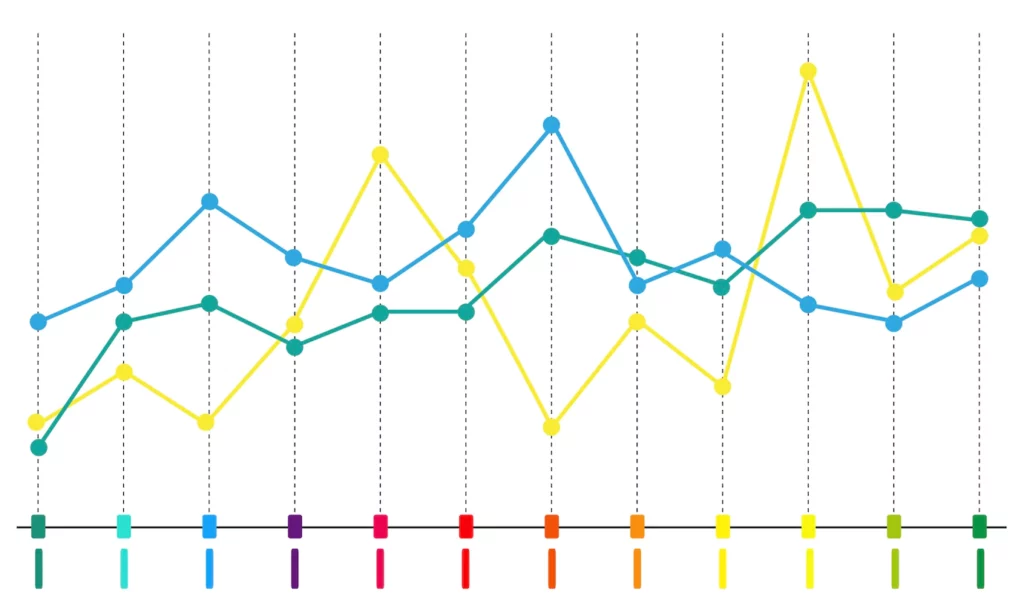

This is evident in 2022 where the BoE has risen from 0.5% to an all-time high of 3%.

Interest rate shock can happen with tracker rate mortgages, so make sure to discuss with your broker all circumstances when deciding on a tracker rate mortgage.

Advantages and disadvantages of a tracker mortgage?

As the name implies, a tracker mortgage rate tracks the Bank of England’s (BoE) base rate. The base rate is the Bank of England’s interest rate on cash held by commercial banks and building societies. The Bank of England evaluates the base rate monthly and adjusts it as needed to meet its target inflation rate of 2% per year, depending on external circumstances.

If you are unsure whether a tracker mortgage is best for you, weigh the benefits and drawbacks to discover if this sort of loan is a good fit for your situation and financial goals. While we always recommend speaking with an expert advisor to ensure you receive the best advice and mortgage rates available, this is to lay out some of the benefits and drawbacks of tracker mortgages.

As with all mortgages, tracker mortgages have advantages and disadvantages.

Advantages of tracker mortgages

- When interest rates are lowering, tracker mortgages are the most appealing option. • They are straightforward, altering only when the central bank lowers or rises interest rates and rising or falling in the same proportion as the base rate.

- If the rate reduces, it may be possible to overspend on your revised monthly mortgage payment. • Even though your tracker mortgage is linked to interest rates, some programs include a rate cap that cannot be exceeded.

Disadvantages of tracker mortgages

- Because a tracker mortgage is connected to base rates, if the rate it monitors rises, so will your tracker mortgage rate and your monthly mortgage payment.

- If interest rates rise faster than predicted and you wish to transfer mortgage products, you may be charged an early departure fee if you do so before the fixed-term period finishes. • Some tracker mortgages have a ‘collar,’ or a rate that they will not fall below even if the central bank reduces interest rates significantly; this means you may not profit from sustained rate decreases.

The benefits and drawbacks of tracker mortgages that we have discussed can help you decide which sort of mortgage to choose.