Land Mortgage in the UK (Complete Guide with Tips & Tricks)

The following topics are covered below:

Purchasing a piece of land can be both financially wise and exciting, but often requires external financial aid as lands aren’t a cheap commodity. While it is a common practice to get a mortgage to buy a house or property, managing land mortgages can be challenging.

However, many people still want to build their dream house on a plot and search for suitable land mortgage options to secure the land in their preferred location. Some may want to convert it into a commercial property or agricultural land. But lenders are often reluctant to provide land mortgages.

That is why many individuals want to know more about land mortgages, how they work, and how to get the best deals. This article aims to cover all of these aspects. Let’s start with the most common question we face.

Can I Get a Mortgage for Land?

The simple answer is YES, you can get a mortgage for land. However, it’s important to have a clear purpose or intention behind purchasing the land.

In the case of regular mortgages, such as a residential mortgage or buy-to-let, you purchase a plot with a structure built on it. This structure increases the value of the land and provides a regular return. However, a piece of land on its own lacks these features, which is why lenders often view it as a risky investment.

However, if you have a clear intention or purpose for purchasing the land, it can provide assurance to lenders, increasing the likelihood of securing a land mortgage. Additionally, a strong application can also boost your chances of obtaining a land mortgage, as there are still many lenders in this market. Let’s delve deeper and learn more about land mortgages in the UK.

However, if you have a clear intention or purpose for purchasing the land, it can provide assurance to lenders, increasing the likelihood of securing a land mortgage. Additionally, a strong application can also boost your chances of obtaining a land mortgage, as there are still many lenders in this market. Let’s delve deeper and learn more about land mortgages in the UK.

What is a Land Mortgage?

A land mortgage is essentially obtaining a loan to purchase some land. This may be for reasons such as building a property or for business purposes. Legally, a land mortgage involves the transfer of property interest as collateral for a loan or other obligation.

Types of Land Mortgage offered in the UK.

The authority effectively regulates lands in the UK; every piece of land is designated for a specific purpose. Unfortunately for those who envision quaint do-it-yourself homes in the countryside, it’s not possible to just buy a large piece of forest, chop down some trees in the middle, and build a house! As a result, many different types of land mortgages exist in the UK, based on the intended use of the land.

1. Self-Build Mortgage

This is when someone wishes to acquire a piece of land to build their property from scratch. This cannot be done using a standard residential mortgage; therefore, a self-build mortgage is necessary.

Once a self-build mortgage has been acquired, the lender will release the money in stages. For example, the first stage would be to fund the acquisition of the land and then release further funds to purchase the materials needed to construct the property.

2. Agricultural Mortgages

An agricultural mortgage is possible to obtain for business purposes or for future investments. Many individuals may wish to obtain an agricultural mortgage to acquire land where they can farm and produce crops.

You can secure a land mortgage to finance the purchase of agricultural land as a standalone business venture or as a long-term investment.

3. Woodland Mortgages

Often, individuals purchase an area of woodland purely as an asset and a form of investment, as permission to make changes is not typically granted.

4. Commercial Development Mortgage

This is when businesses are looking to purchase a piece of land to develop it further, such as building a supermarket or a block of residential homes.

How Does Land Mortgage Work in the UK?

When trying to secure a mortgage, whether it’s for residential purposes or creating an investment opportunity, lenders will look for certain essential things. They want to know how their investment in you will benefit them and how risky it is for them to lend you a mortgage. They are seeking a low-risk, high-reward solution. If the lender believes you are a worthy investment, you can secure the mortgage and proceed with your plans for building properties or other business purposes.

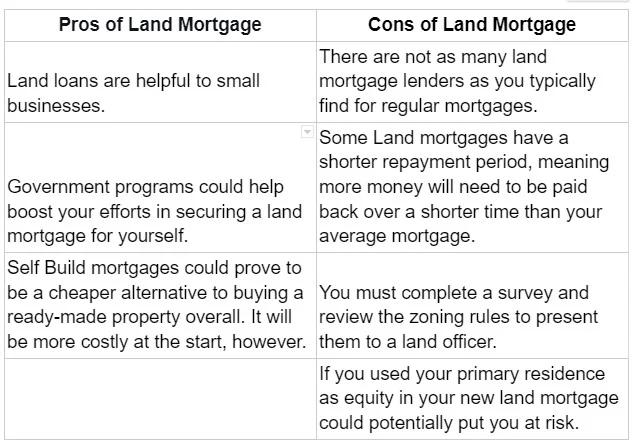

Pros and Cons of Land Mortgage

Things You Need to Know to Secure a Land Mortgage

Do you pay stamp duty on a land mortgage?

Stamp Duty Land Tax will have to be paid when purchasing a piece of land. Different rates apply depending on the person who buys the land and the property. Please go to our stamp duty calculator for further information.

Will you need planning permission for a mortgage on land?

Having planning permission when purchasing a piece of land is a crucial factor, especially for the lender. Lenders view it as a higher risk when planning permission has not been granted, which can affect the mortgage LTV and the rates offered. In most cases, lenders will not offer more than 65% LTV if planning permission has not been obtained beforehand.

However, in many instances, when someone is trying to purchase land in the UK, planning permission has already been granted, as the current owners have not made any changes, making it less of a problem for the prospective buyers.

How much deposit is required for a land mortgage?

As mentioned earlier, securing a land mortgage in the UK is not as straightforward as getting a residential mortgage. This is because lenders require a larger deposit and are less willing to invest in something they consider high risk, as many land mortgages in the UK do not come with a readily-saleable home. They see it as a slow-moving market, which poses a greater risk to them.

In most cases, for land mortgages in the UK, lenders will ask for a deposit of around 30%, which is significantly higher than the potential 5% deposit required for a residential mortgage. This highlights how difficult it is to secure a mortgage in this market, as lenders see it as high risk.

If you are a first-time buyer seeking a land mortgage, you will need to show your deposit as savings. However, if you already own a property or have a current mortgage, you can potentially use the equity in that home to secure a deposit for the land purchase.

Other Land mortgage criteria in the UK

Lenders would view your application as a strong candidate if you can clearly outline a business plan for securing the land mortgage. This plan should include details such as the stages of building, the costs, and the materials required.

If you have a well-thought-out plan, lenders are likely to see you as a trustworthy and lower-risk investment. Whether you are building for personal use or for investment and commercial purposes, this will be the same. This could result in lower interest rates and better offers from lenders. It’s common for lenders to reject applications that lack detail and depth.

In addition to a clear business plan, your affordability and credit history are also crucial factors when trying to secure a mortgage. Lenders are always looking for low-risk situations, so if they believe you cannot afford the land mortgage in the UK or have a poor credit history, they may reject your application. Lenders will closely review your income, outgoings, and credit history to determine if you are a suitable candidate.

Like any other mortgage in the UK, there are fees that must be paid during the process of securing a land mortgage, including:

- Application Fees: This is a fee paid to the broker or lender to cover the costs of processing your application.

- Valuation Fee: This is a fee paid to the lender to have a qualified surveyor inspect the land and provide its value.

- Legal Fees: This is a fee paid to the solicitor who handles the transfer of funds and the land ownership. In some cases, you may also have to pay for the lender’s solicitor.

How to Get a Mortgage for Land in the UK

1. Decide which type of Mortgage You Need.

The first step in securing a land mortgage in the UK is deciding what type of mortgage best suits your needs. For instance, do you require a self-build mortgage for personal use or a commercial land mortgage for business purposes? It is important to have a clear vision of your intentions and to have a comprehensive business plan, as this will strengthen your application.

2. Prepare the Paperworks Needed for Land Mortgage

As with every other mortgage, you will need the necessary paperwork to apply for a land mortgage. Documentation that demonstrates your income and outgoings will be essential in providing the lender with the correct information, so they can assess your eligibility for a mortgage. Having all of the proper documents and paperwork in order will make the application process easier and smoother when applying for your land mortgage.

3. Apply for Mortgage

Once you have decided on the type of land mortgage you want and gathered all of the required paperwork, you can start the application process. It is essential to cooperate with the lender when they request additional documents, in order to complete the process efficiently and as quickly as possible. After this step, you can wait for the best offers and rates.

4. Next Steps

If the lender accepts your application and is willing to invest in you, you can move forward in securing your land mortgage. There will be a survey and zoning check before everything can be finalised. Your mortgage will then be passed on to a solicitor to complete the finalisation process.

Tips and Tricks to Increase my chances of getting accepted for a land mortgage-

- Improve your credit score: Research and take the necessary steps to increase your credit score. This will significantly boost your chances of securing a land mortgage in the UK.

- Decreasing your expenses: By cutting unnecessary expenses, you will have more money to put towards your mortgage payments, which will help your application and creditworthiness. Another option is to pay off any other debts you have, which will show the lender that you have more funds available.

- Increased Deposit: Putting down a larger deposit will mean that your loan-to-value (LTV) ratio will be lower, which the lender will view as a lower-risk situation and will be more likely to invest in you and approve your mortgage.

- Speaking to a Broker: Speaking to a specialist broker can help you find the best rates from lenders, regardless of your circumstances. The broker will be able to assist you in the process and find a solution that works for you.

How Expert Mortgage Brokers Can Help?

Expert Mortgage Brokers are available to provide the necessary service when you are searching for a mortgage. Securing a land mortgage can often be difficult, but with the help of one of our experts, we aim to assist our clients in securing the best offers and rates from our lenders. This will enable us to meet and satisfy our customers’ needs, regardless of their situation.