A Brief Guide on Student Buy to Let Mortgages for Investors

Are you an investor who is interested in the student buy to let mortgage market? If so, this blog post is for you! In it, we will provide a brief guide on student buy-to-let mortgages, including what you need to get approved and some of the pros and cons of investing in this market. We will also include some tips regarding investing in a student let property. So, whether you are just starting out or are already familiar with student buy to let mortgages, we hope that you find this article helpful!

Need expert advice on student buy-to-let mortgage?

Schedule a ConsultationThe following topics are covered below:

Pros and cons of buy to let student property

Advantages of buy to let student accommodation

- University apartment blocks are very popular with first-year students, which could be a good move; however, students’ homes that allow friends to stay with each other are often the better option as there is more demand for this.

- There is always a demand for student accommodation, so it can be a great investment opportunity for those looking to receive more rental income. Having a few could boost your gains significantly.

- Mortgage payments are less of a hassle since there is a tenancy agreement in place, often signed by the parents. This also means that sometimes payments are made in advance, such as for a whole term. This is why it’s seen as a way of a secure continuous income.

Disadvantages of buy to let student property

- Student Property Investment is seen as a long-term investment rather than for the short term; therefore, it should align with your investment goals. Income received from the student let can be great but starting off can often be expensive, so profits will not show instantly.

- Student HMOs have a higher start-up cost as, in most cases, the property would need to be refurbished. Even if a property is already built to HMO standards, it may need to be upgraded using new furniture and decorations for students to stay.

- Often with student accommodation, management costs are far greater than renting a home to your typical family. This is because many people are sharing one home, and agents may incur some problems along the way.

- Young adults and students tend to party a lot when being around friends, which means that maintenance costs will be higher as students may not keep the house clean and need time to get used to living away from family homes.

- Lastly, there is much more legislation regarding student buy to let compared to your normal buy to let. You will need to correspond with this accordingly, or potentially huge fines could be thrown your way or even imprisonment in severe circumstances.

Eligibility Criteria of Student Buy to Let Mortgages

Legal Requirements of BTL Student Property

- When trying to secure a student buy-to-let mortgage for a Student HMO, you may need to apply for an HMO license if your property meets the requirement for this property type.

- Like any other mortgage, lenders will give you a loan over a certain period of time and follow the same concept as any other mortgage on the market.

Financial Requirements of Student BTL

Rental Income: Your rental income needs to be 125% of the mortgage cost for the lender to be confident in giving you the loan. Some lenders may even ask for a higher figure and that your personal annual income is above £25k.

Deposit Amount: For student buy-to-let mortgages, deposits can be higher, so this is something to keep in mind.

Credit History: Clean credit is always a bonus whenever you want to try to secure a mortgage. The same goes for student buy-to-let mortgages; however, there are specialist lenders in the market who are willing to lend if you have any credit issues.

Property Type: Specialist lenders may be needed when trying to get a mortgage on a ‘non-standard’ property such as a student HMO.

How to Get Student Buy to Let Mortgages

The first step would be assessing your financial situation and investment goals. You should consider what area in which you want to buy your property. When looking at properties, you should look at something you think would be suitable for young adults. Some things to consider would be things such as if there is parking space as students may want to keep their vehicles near their living place.

Once you have thoroughly picked the property you wish to buy for the right price, you should get it surveyed.

Find a buy-to-let mortgage that suits you by researching and ensuring it’s the right move. In most scenarios, the property would be considered an HMO. Therefore, you will need insurance and may also need to register the property. This means that you must adhere to certain rules, such as having a fire alarm in every room.

Once all this is complete, you should speak to a broker who will help you secure your mortgage with unique lenders. They will be able to advise you in getting your student buy to let and any other enquiries you may have.

After this, the property is in your hands, and you can start renting it out to students, and the rental income will come in shortly after.

Tips and Tricks for Getting the Best Rate on Student Buy to Let Mortgages

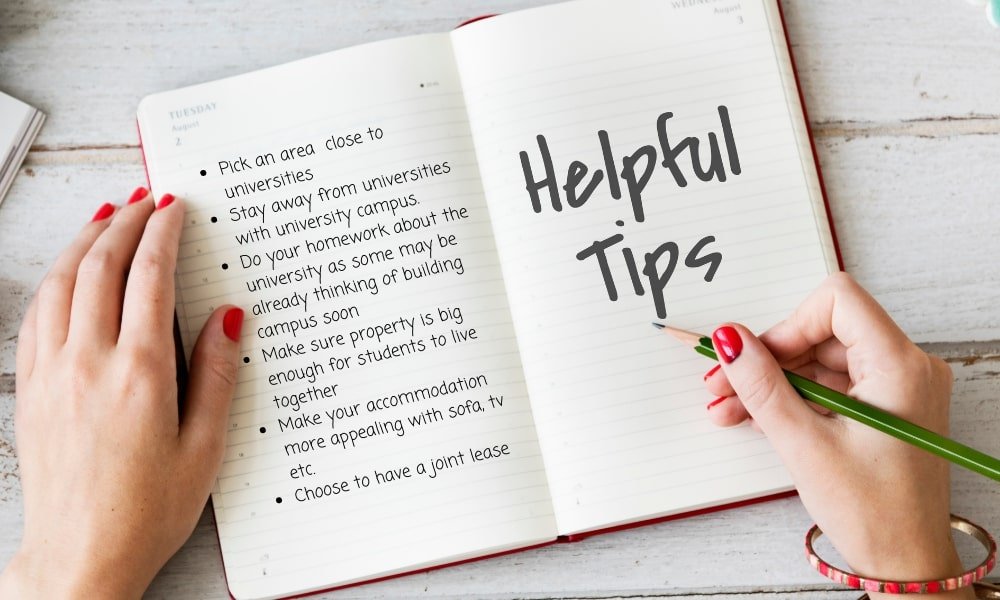

- Picking an area in which there are close universities nearby as this would boost your chances in always having students who are willing to stay at the property as they are in need of it.

- Stay away from universities that already have accommodation on universities campus. Because the majority, if not all, students would opt in for that instead of private property.

- Do your thorough research about the university, as some may be already thinking of building campus housing in the near future, making your investment riskier and far less profitable.

- Make sure the property has at least 3-5 bedrooms and decent living spaces as many students would prefer to stay together.

- Make your accommodation more appealing than others by having a lounge area, sofa, TVs, and a washing machine for example. This would be more suitable for students as they are already taking many things with them from their old homes.

- Choose to have a joint lease as this means that you’re always guaranteed to have a fixed amount of rental income each month compared to having separate agreements where one person may choose not to pay.

Frequently asked questions about student BTL Mortgage

How much deposit do you need to get student buy to let mortgages?

As with most mortgages, you must have a deposit before applying for the actual mortgage. Most lenders would ask for 25% but having a greater amount such as 40% is better as that’s when lenders can offer you the best rates and deals on the market. On the other hand, there are some lenders who are willing to offer you a mortgage amount with a deposit of less than 25% however the interest rates will be far greater and lender fees can increase as well.

Do you pay stamp duty on student accommodation?

No! You do not have to pay Stamp Duty for student buy-to-let mortgages.

Can I let a student BTL to a family member?

For this circumstance, you will need a family buy-to-let mortgage rather than students buy to let mortgage. This is also known as a regulated buy to let mortgage and is a niche mortgage type.

Can I get a student BTL if I have bad credit?

Yes. There are many lenders in the market who are willing to offer you a mortgage with bad credit. However, the rates and fees will not be as nice to you as those with a perfect credit history.

Is student letting profitable?

Student letting is seen as profitable if you make the right decisions in the process. Speaking to a specialist advisor can help you with this. Profits may not be seen as instant as the start-up cost is high; however, it can create a secure income after this stage.

How long is a student BTL tenancy?

In most cases, the agreement would be for 12 months, and there is no chance of it being broken before then unless certain rules are broken.

Hope you liked this article. If you are interested in generating income from renting out houses and want to know more about buy to let mortgages, then you may also like the following contents.

How to Get a BTL Mortgage Without a Job

Is renting a house without a buy-to-let mortgage illegal?

Buy to Let Equity Release Explained

Do you have any other questions about student buy to let mortgages? Leave them in the comments below, or give us a call or schedule a free meeting with our expert mortgage advisor and we’ll do our best to help you out!