Evolution of Mortgages Between 2008 and 2022

Between 2007 and 2008, we witnessed a financial crisis which originated from excessive liquidity afforded by lower interest rates and the active securitisation of mortgages. The 2008 financial crisis was the worst economic crisis since the Great Depression in 1929

It all started in 2006 when housing prices started to decrease for the first time in decades. People were quick to think that the real estate market would benefit but failed to see that too many homeowners were being approved to receive mortgages even with bad credit. Some believe this was due to the Community Reinvestment Act, which encouraged banks to lend to low to middle-income households. This act was formed in 1977.

Many other factors quickly came to light as people started to blame the mortgage agencies such as Fannie Mae and Freddie Mac for the cause of the crisis as they wanted to privatise the company which would in return cause the whole housing market to collapse as they where the ones who guaranteed majority of the mortgages.

After the rapid decline of house prices in 2007, banks started to panic after realising they would suffer severe losses. This caused them to stop lending to each other. They didn’t want other banks to give them worthless mortgages as collateral, therefore causing interbank borrowing costs to increase. The Federal Reserve began acting as they pumped liquidity into the banking system via the Term Auction Facility, but it hardly had a positive impact.

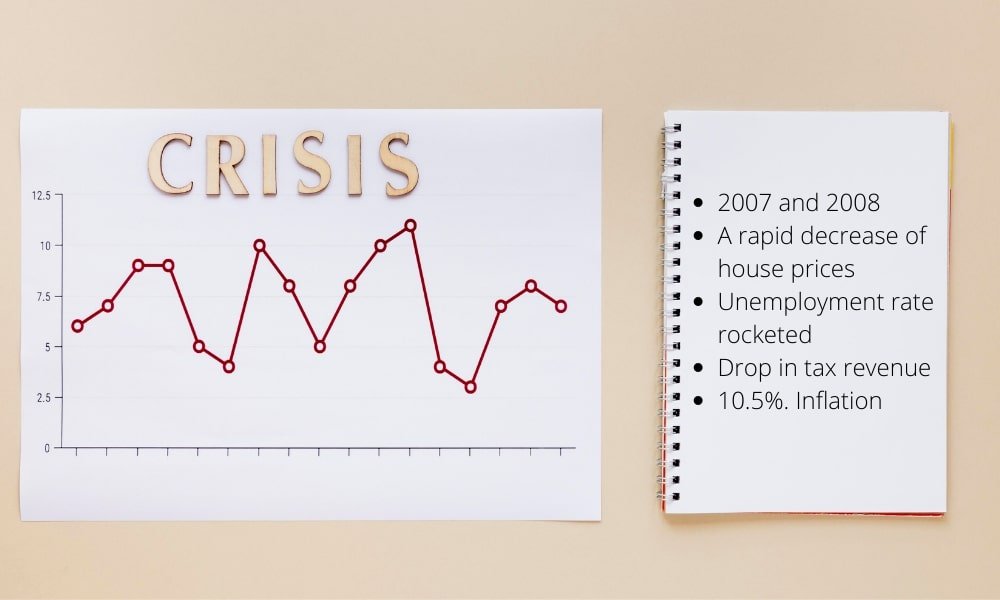

As with any financial crisis, there is consequences, and this is known as the cost of the crisis. The United Kingdom was impacted far more than most other countries. This was because the economy had to rely on financial services, real estate, and retail sales for growth. Soon to be broken due to the risky credit borrowing and lending bubble which burst in 2008. These industries were hit hardest by the financial crisis which caused a rapid decrease in housing prices and the drying up of credit sources. This in return would cause the UK economy to have many long-term consequences. Reports concluded the argument that the UK economy relied too much on the service industries.

Following the cutbacks in housing and retail sales, the unemployment rate rocketed due to widespread redundancies. This only made the impact of the crisis far worse on the UK economy. With companies going bust and the unemployed looking for jobs, there was a drop in tax revenue which meant the government had to cut public spending meaning they were unable to boost the economy by investing in public services. The downfall only continued as the GDP fell for a fourth consecutive quarter at the end of 2008. By November 2008, house prices had fallen by 10.5%. Inflation was at its highest.

The consequences of the 2008 financial crisis can still be seen today in the mortgage industry. Mortgages are harder to secure with banks only lending to those who can afford it with good credit unlike in 2008 when mortgage loans were given to anybody completely disregarding whether they have the financial capabilities of paying back that loan. It was essentially a lesson for the banks as to what needs to be considered to make sure something like the 2008 disaster never happens again. Banks are now more sophisticated when it comes to giving out mortgages which is a key change in the way they lend money to people. An example would be requiring higher deposits. The loan default risk is now 2.3% compared to over 16% in 2006.

Often it is argued whether the housing market could come crashing down again like in the past, but it is also believed that it can not be possible due to some factors. A key factor being that the demand for housing in the UK is at its peak especially in London. With this and the ever-growing population in the UK, there will always be someone willing to pay the price for a property therefore a downfall in housing prices seems out of the picture.

On the other hand, a increase which has been happening for the past decade could carry on in its upward trend making the market increase. This can be further argued by the fact that a housing crisis means that more houses need to be built for more people.

Furthermore, if the market was ever to be affected again, it is almost guaranteed that government intervention and scheme would come into effect in order to save the housing market. This is why I believe that the housing market will not go back to how it was during the 2008 financial crisis.